- cross-posted to:

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- cross-posted to:

- [email protected]

- [email protected]

- [email protected]

- [email protected]

cross-posted from: https://lemmy.world/post/18844195

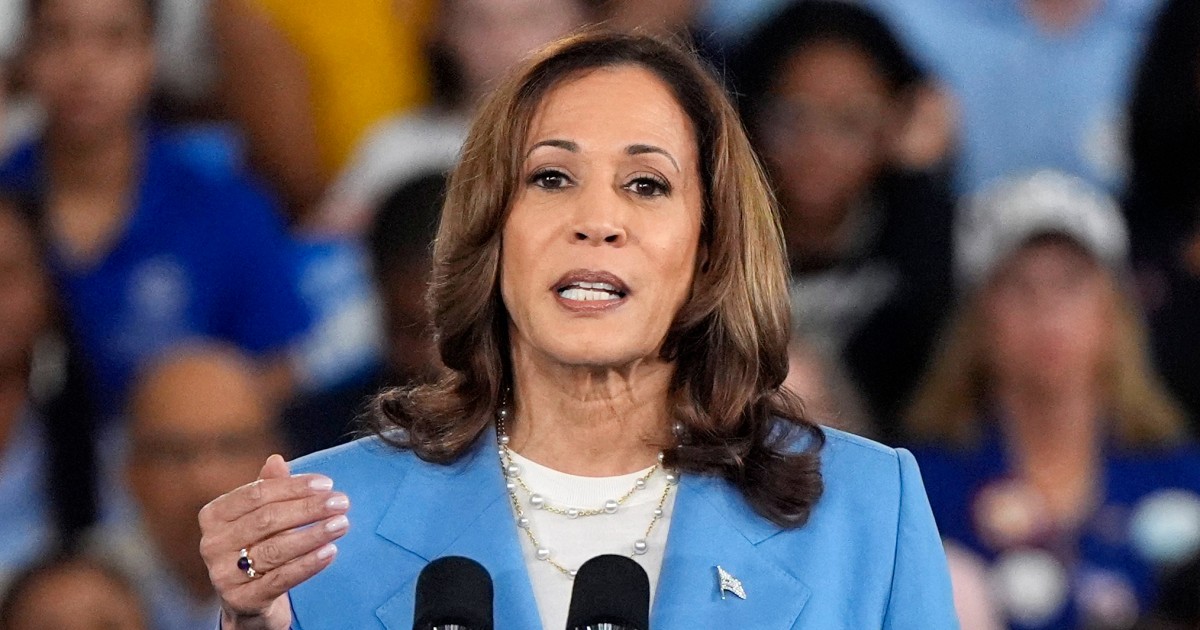

Harris proposes raising the corporate tax rate to 28%, rolling back a Trump law

The vice president is rolling out her first revenue-raising policy proposal as the Democratic presidential nominee and drawing a contrast with GOP opponent Donald Trump.

Vice President Kamala Harris is calling for raising the corporate tax rate to 28%, her first major proposal to raise revenues and finance expensive plans she wants to pursue as president.

Harris campaign spokesman James Singer told NBC News that she would push for a 28% corporate tax rate, calling it “a fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

…

If enacted, the policy would raise hundreds of billions of dollars, as the nonpartisan Congressional Budget Office has projected that 1 percentage point increases in the corporate rate corresponds to about $100 billion over a decade. It would also roll back a big part of former President Donald Trump’s signature legislation in 2017 as president, which slashed the corporate tax rate from 35% to 21%.

Trump, meanwhile, recently said he would cut taxes even further if elected president, including on businesses.

Let’s go back to 50% like in the 50s and 60s.

I really wish we could focus on the actual causes of high government spending instead of this or that tax rate.

I tend to think it’s due to use it or lose it budgets. Same thing happens outside government too. You get a chunk of money to use, and if you don’t spend it all, you’ll probably get less next year. If you spend it all, you might be able to argue for more next year since you ran out.

There’s little incentive for the groups doing the spending to save a lot of money, especially if they know they only take a tiny piece of the enormous pie. But it collectively causes that pie to have to be enormous.

Is there any real world solution to this endemic behavioral incentives problem with some history of large scale long-term success? Naive solutions can easily backfire or lead to corruption. You don’t want to incentivize cutting so much that necessary spending is impacted either.

Does it really matter what the rate is when they don’t pay it anyway?

"The analysis names 35 corporations, including Tesla, Netflix and Ford, that each reportedly spent more on compensation to their five highest-paid executives than they paid in federal income taxes over five years.

Collectively, the 35 corporations spent $9.5 billion on their top executives over that span, the report said, while their combined federal tax bill came to -$1.8 billion: a collective refund."