DRS in Millions (10-Q & 10-K)

- 10/30/21 20.80

- 01/29/22 35.60

- 04/30/22 50.80

- 07/30/22 71.30

- 10/29/22 71.80

- 03/22/23 76.00

- 06/01/23 76.60

- 08/31/23 75.40

DRS in Millions (What if Cede Would Lie?)

- 10/30/21 20.80

- 01/29/22 35.60

- 04/30/22 50.80

- 07/30/22 71.30

- 10/29/22 71.80

- 03/22/23 103.2382

- 06/01/23 114.7828

- 08/31/23 129.5794

It might be hard to visualize, but the last 3 fake data points do include a smaller slope by including the data point where we “only” added 0.5M in October of 2022.

But what if Cede fucked with the reporting for October specifically, knowing that the last 2 real data points (71.3 and 71.8) would only show a slope of ~0.5M a quarter?

Why do youyouyou think Gamestop changed the wording from 03/22/2023 onward?

It seems the underlying question is if the DTCC has any effect on what Computershare provides GameStop for the DRS numbers.

I’m assuming Computershare the transfer agent keeps its own share count and provides the information to GameStop.

Assuming there is no DTCC step where the DTCC tells Computershare what’s on DTCC side, so Computershare has to fudge their numbers to match, then tell GameStop.

Has there been any information that shows the flow of share count data is:

If we include the non-official DRS numbers with the official GameStop SEC filings:

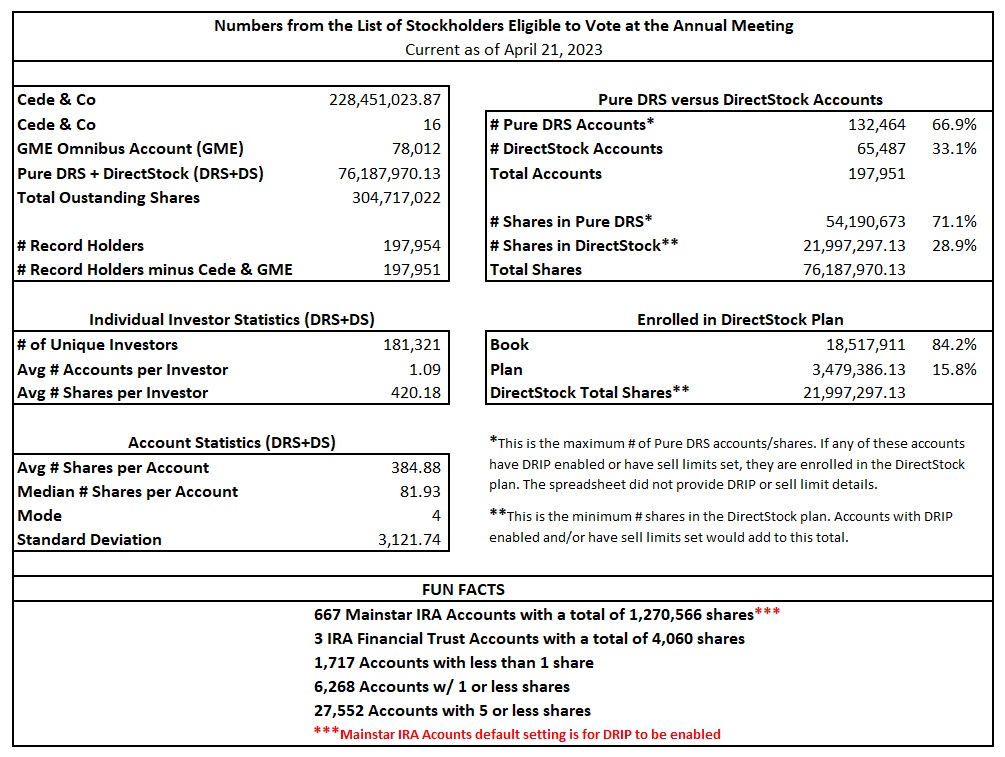

The May 2023 visit to GameStop HQ for the 04/21/23 list of stockholders numbers:

Using your numbers:

From a dollar amount $1,352,940,000 / 200,000 Computershare accounts = $6,765 each / $22 avg = +308 shares each over 10 months (31 shares a month).

Plausible, but it may be tough for the average holder to spend $676 a month on GME shares. And without the whales buying as much as they initially did, it skews the numbers down too.

I’m looking at the Numbers from the List of Stockholders you provided, and there are some wild statistics. For example the ‘mode’ for # of shares is 4 but the Std. Deviation is 3,121.